All Categories

Featured

Table of Contents

He released the "Infinite Banking Principle" (IBC) in the U.S. in 2000, and ultimately it moved to Canada. An short article on unlimited banking that appeared both on and in the Financial Blog post early in 2022 birthed a simplified heading that stated, partly, "exactly how to keep your money and spend it too." The writerClayton Jarvis, after that a MoneyWise home mortgage reporterframed the idea by stating that the trouble with the typical Canadian's capital is that it's typically doing just one work at a time: it's spent, provided or spent.

Get customized quotes from Canada's leading life insurance coverage providers.

Essentially, this is a life insurance policy sale. If one embarks on an outside or collateralized car loan versus a policy finance, they might be compensated on the loan too.".

Infinite Banking Wikipedia

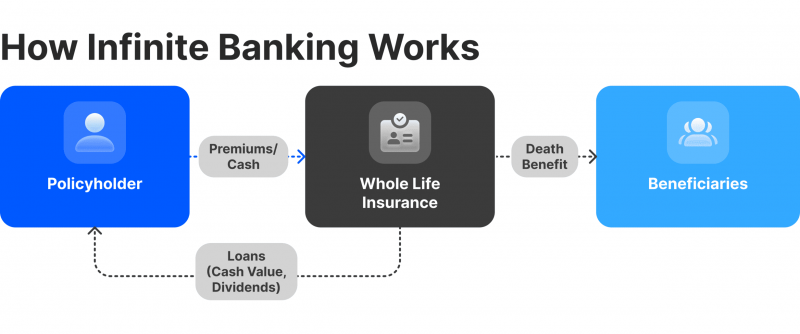

Numerous people have actually never heard of Infinite Banking. We're right here to change that. Infinite Banking is a way to handle your money in which you create a personal financial institution that works simply like a routine bank.

And thanks to the cash worth savings section of your entire life insurance policy policy, you're able to take policy finances that will not interrupt the development of your money. Therefore, you can fund anything you require and desire, i.e.,. Just put, you're doing the banking, however rather than depending upon the standard financial institution, you have your very own system and full control.

Infinite Financial isn't called that method without a reasonwe have unlimited means of executing this process right into our lives in order to really own our way of life. In today's write-up, we'll show you 4 different methods to utilize Infinite Banking in organization. In addition to that, we'll go over 6 ways you can use Infinite Financial personally.

Infinite Banking Insurance

When it comes to service, you can use Infinite Financial or the cash money value from your whole life insurance policy policies for start-up prices. The money is right there, and you pay that cash back to on your own.

Why not treat on your own the specific same method? The principle of Infinite Banking functions only if you treat your individual bank similarly you would certainly a regular bank. You can additionally make use of finances for one of one of the most essential points, which is taxes. As a business proprietor, you pay a great deal of money in taxes, whether quarterly or yearly.

Infinite Banking Insurance

By doing this, you have the money to pay tax obligations the list below year or the following quarter. If you want to learn more, have a look at our previous write-ups, where we cover what the tax benefits of a whole life insurance policy plan are and how you can pay taxes through your system.

You can conveniently lend money to your service for costs. After that, you can pay that cash back to yourself with personal rate of interest.

We utilized our dividend-paying life insurance policy to buy a property in the Dominican Republic. It's not sufficient to only discover regarding money; we require to comprehend the psychology of cash.

Well, we used our entire life the same method we would certainly if we were to finance it from a bank. We had a mid- to low-level credit history score at the time, and the passion rate on that auto would certainly be around 8%.

Be Your Own Banker Life Insurance

Infinite Financial is replicating the conventional financial process, but you're catching rate of interest and growing cash rather of the financial institutions. The amount of of us are burdened with medical costs that we sometimes can not pay? We finish up charging them on a charge card and making regular monthly repayments back to that card with principal and rate of interest.

One of the finest ways to make use of Infinite Financial is to pay down your financial obligation. Infinite Banking gives you control over your financial functions, and then you truly begin to look at the money in different ways.

Are you interested in doing the exact same? Keep reading this post and we will reveal you just how. Just how lots of people are strained with pupil finances? You can pay off your pupil financial debt and ensure your kids' university tuition many thanks to your entire life plan's money worth. Everything we recommend below is due to the fact that we understand individuals are presently doing it themselves.

Once again, the wonderful feature of Infinite Banking - life rich banking is that the insurance provider does not ask you, "What is this cash for?" That permits you to use it for whatever you desire. You can use your financings for a selection of different points, yet in order for Infinite Banking to work, you need to ensure that you follow the 3 policies: Pay on your own first; Pay yourself passion; Recapture all the cash so it returns to you.

That's due to the fact that this point can expand and make best use of nevertheless you spend money. Besides, everybody's way of living is completely different from the following person's, so what might be convenient for us may not be hassle-free for you. However most importantly, you can use Infinite Financial to fund your own lifestyle. You can be your own banker with a way of living banking strategy.

With an entire life insurance coverage plan, we have no risk, and at any type of moment we understand what is taking place with our money due to the fact that just we have control over it. From which life insurance coverage business should I get my entire life plan?

Life Insurance Infinite Banking

When you put your money right into banks, for you, that cash is just sitting there. It means the sum you place in expands at a specific passion price, but only if you don't utilize it. If you require your cash for something, you can access it (under some problems), but you will certainly interrupt its development.

Simply put, your money is helping banks make more money. You can't construct wealth with normal financial institutions since they are doing it instead of you. But,.

For most individuals, the biggest issue with the limitless banking idea is that first hit to very early liquidity created by the costs. This disadvantage of infinite financial can be lessened significantly with proper plan layout, the initial years will certainly constantly be the worst years with any Whole Life plan.

Nelson Nash Infinite Banking Book

That said, there are particular boundless financial life insurance coverage policies created mainly for high very early cash value (HECV) of over 90% in the initial year. Nonetheless, the lasting performance will frequently considerably delay the best-performing Infinite Banking life insurance policy plans. Having access to that extra four numbers in the first few years might come with the expense of 6-figures later on.

You actually get some substantial lasting advantages that aid you redeem these very early costs and then some. We locate that this impeded very early liquidity problem with limitless financial is a lot more mental than anything else as soon as thoroughly discovered. If they definitely needed every dime of the cash missing from their unlimited banking life insurance policy in the first couple of years.

Latest Posts

Banking Life Insurance

Infinite Banking Concept Updated For 2025

Non Direct Recognition Insurance Companies